Achieve PCI compliance and keep your customers’ data secure

Easily ensure complete card holders data protection

Automating the PCI-DSS audit process provides multiple benefits, including increased efficiency and accuracy, reduced risk of errors, and improved compliance. By automating the audit process, you save time and resources that would otherwise be spent on manual, time-consuming tasks. Additionally, automating the process ensures all relevant data is collected and analyzed accurately, reducing the risk of errors or omissions, helping you avoid potential fines or penalties for non-compliance.

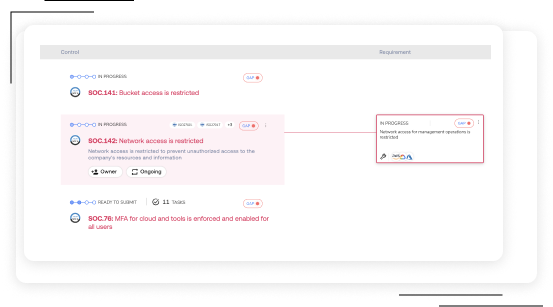

Essential information security controls

Cypago automates all required security controls that cover system and network security, patch and update management, authentication protocols enforcement, employee security training and much more.

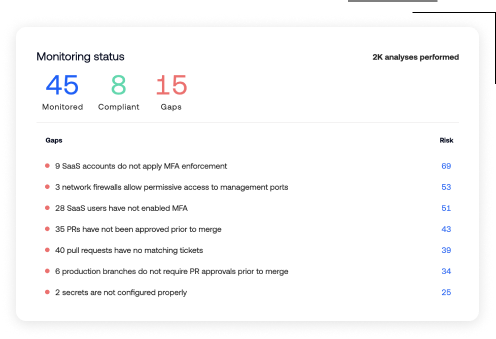

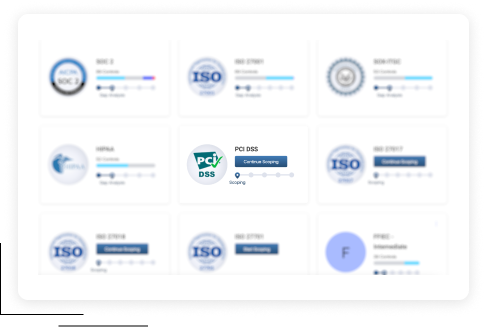

PCI DSS compliance monitoring

Regularly monitoring and testing systems and networks to identify and address potential compliance gaps can be a pain. Cypago does all that for you and provides an ongoing compliance monitoring dashboard including an in-depth understanding of the gaps, control implementation lifecycle and overall compliance posture.

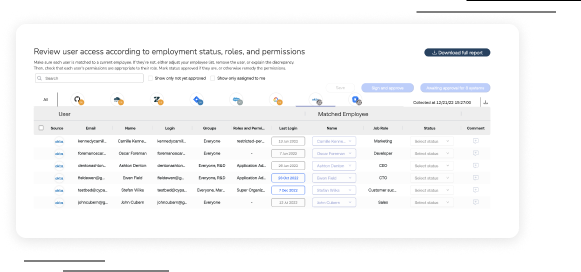

Access reviews & control

Maintaining strict control over access to sensitive data is a foundational concept in the PCI DSS framework.

By leveraging Cypago’s powerful User Access Review module, users enjoy an automated, streamlined access review process. From data source selection to assigning responsibilities to one-click reviews, you can have it done in minutes.

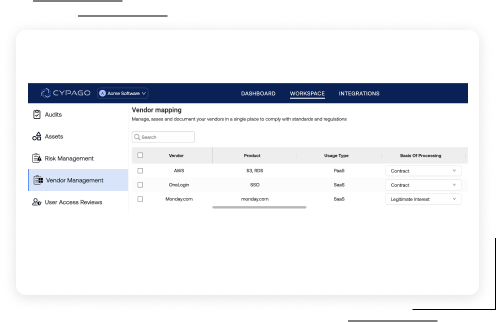

Supply chain compliance

PCI DSS mandates that all third-party vendors and partners be compliant with PCI DSS requirements to avoid potential vulnerabilities through these external connections. Use Cypago’s Risk Management capabilities to collect, monitor and alert on third-parties PCI DSS compliance and overall risk status.

Costs reduction

Becoming PCI DSS compliant involves high costs when done manually. Hiring and training staff to manage the compliance process, ongoing expenses for conducting regular assessments, fines and penalties for non-compliance, and the costs of business loss and reputation damage can occur if a breach occurs. The Cypago compliance platform significantly reduces these costs and provides a streamlined compliance experience.

PCI compliance made easy

PCI compliance was born with the increased adoption of digital payments by a consortium of key players in the card industry to help reduce fraud and to ensure consistency of processes and sensitive information security.

By leveraging Cypago, adhering to PCI DSS and monitoring data management, data development, storage, and security becomes a streamlined and cost effective process.

If you have any questions or comments about any of the above, please feel free to contact us.