In today’s rapidly evolving business landscape, effective risk management has become paramount to the success and sustainability of organizations across industries. To meet this challenge, the Institute of Internal Auditors (IIA) introduced the “three lines of defense” model in 2013 as a structured approach designed to distribute risk management responsibilities throughout an organization. However, as technology advances and cyber threats become more sophisticated, traditional risk management approaches are facing new obstacles.

In this blog, we delve into the “three lines of defense” model and explore how Cypago, a cutting-edge Cyber GRC Automation platform, breaks away from the conventional mold to revolutionize risk management for the digital era.

What is the Three Lines Model?

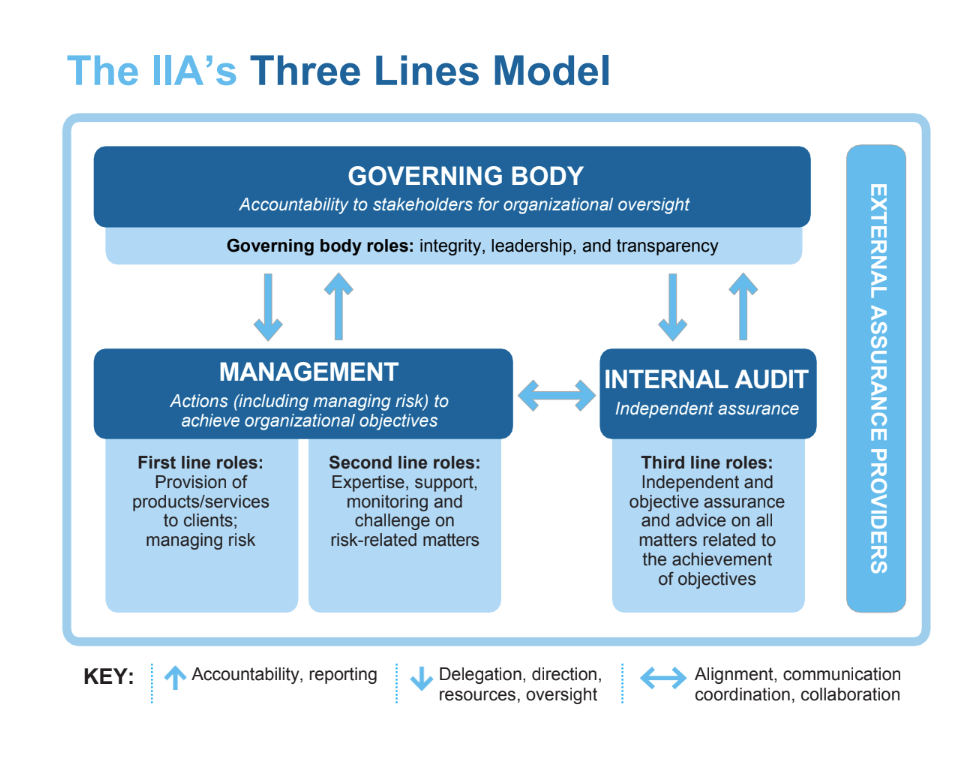

The Three Lines of Defense model is a risk management framework used by organizations to effectively manage risks and internal controls. It provides a structured way to delineate responsibilities for risk management and control activities across different levels within an organization. The model is widely used in various industries, including finance, banking, and corporate governance.

The Three Lines of Defense model is designed to foster a strong risk culture within an organization and create a robust risk management framework. By clearly defining roles and responsibilities for managing risks and controls, it helps organizations better protect themselves from potential threats and achieve their objectives effectively.

The three lines are:

- First Line of Defense: This includes the operational management and staff who own and manage risks on a day-to-day basis. They are responsible for identifying, assessing, and managing risks within their specific area of responsibility.

- Second Line of Defense: This consists of risk management, compliance, and control functions. They provide oversight, guidance, and support to the first line of defense. They help in establishing risk management policies and procedures and monitor the effectiveness of risk management activities.

- Third Line of Defense: This is the internal audit function, which provides independent and objective assurance on the effectiveness of risk management and internal controls. Internal auditors evaluate and report on the organization’s risk management practices and provide recommendations for improvement.

Let’s dive deeper into each of these lines and understand their role in risk management and prevention.

First Line of Defense: Operational Management

The first line of defense includes all individuals and teams directly involved in day-to-day business operations. This line comprises front-line employees, supervisors, and managers who are responsible for identifying and managing risks within their specific operational areas. They are closest to the processes and activities that generate risks, and their primary focus is on execution.

Their responsibilities include implementing effective internal controls, ensuring compliance with policies and procedures, and promptly addressing issues and incidents as they arise. They are responsible for actively managing risks within their operational area.

Second Line of Defense: Risk Management and Compliance

The second line of defense consists of risk management, compliance, and internal control functions within the organization. This line is responsible for overseeing and supporting the first line in effectively managing risks. They provide guidance, develop risk management policies and frameworks, and monitor the effectiveness of controls.

The second line ensures that risk management practices are consistent and integrated across the organization. They also conduct risk assessments, develop risk registers, and establish risk appetite and tolerance levels.

Third Line of Defense: Internal Audit

The third line of defense is the internal audit function. This line operates independently of the first and second lines to provide objective assurance and evaluation of the effectiveness of the risk management and internal control processes. Internal auditors review and assess the activities of the first and second lines to ensure that risks are appropriately identified, managed, and mitigated.

The internal audit function also verifies compliance with policies, regulations, and industry standards, providing an objective assessment of the organization’s overall risk management and control environment to senior management and the board of directors.

Cypago: Redefining the Three Lines Model

While the traditional three lines of defense model has proven effective in various contexts, the modern business landscape is witnessing unprecedented digital transformation. With organizations relying heavily on technology, the threat landscape has expanded exponentially. Cyberattacks and data breaches now pose significant risks to businesses, requiring a more agile and adaptable approach to risk management. Moreover, the compliance landscape itself continues to evolve and become more complex, and many organizations are juggling the demands of multiple compliance frameworks.

Cypago’s revolutionary SaaS-based Cyber GRC Automation (CGA) platform challenges the status quo by redefining the three lines model to match the demands of the digital age. By combining the power of automation, advanced analytics, and real-time data intelligence, Cypago enables organizations to proactively and efficiently address cyber risks across their operations.

Breaking Down the Barrier Between Lines of Defense

Unlike traditional GRC tactics that separate risk management functions into distinct lines, Cypago’s CGA platform fosters collaboration and synergy among different stakeholders. By unifying risk data and insights into a centralized dashboard, and allowing for easy communication between all stakeholders, Cypago bridges the gap between the first, second, and third lines of defense. With Cypago, the three elements of Cyber GRC – Governance, Risk, and Compliance – can be assessed with one holistic approach, and a highly integrative tool to match that approach.

Automated Risk Assessment and Response

In today’s fast-paced environment, timely risk identification and response are crucial. Cypago’s automation capabilities empower organizations to swiftly detect potential cyber threats, assess their impact, and deploy appropriate mitigation measures. This real-time continuous risk monitoring ensures that organizations stay one step ahead of malicious actors, minimizing the likelihood and impact of cyber incidents.

Enhanced Compliance and Reporting

Compliance with regulatory requirements is an integral part of risk management. Cypago’s CGA platform streamlines compliance efforts by automating evidence collection, streamlining the auditing process for both internal and external stakeholders, and generating comprehensive reports. This not only saves valuable time and resources but also ensures that organizations remain in good standing with regulatory bodies.

The Three Lines Model, Redefined

As the digital landscape continues to evolve, organizations must rethink their risk management strategies to effectively safeguard their assets and maintain a competitive edge. The traditional three lines of defense model, while valuable in its time, is no longer sufficient to combat the dynamic nature of cyber risks. Cypago’s Cyber GRC Automation platform offers a paradigm shift, breaking free from convention to deliver a unified, proactive, and future-proof approach to risk management.

Discover the exciting possibilities and transformational impact of Cypago’s revolutionary Cyber GRC Automation platform on modern risk management practices. Schedule a demo with us today.